Debt and Inflation

Tackling Record Inflation and Preventing a Debt Crisis

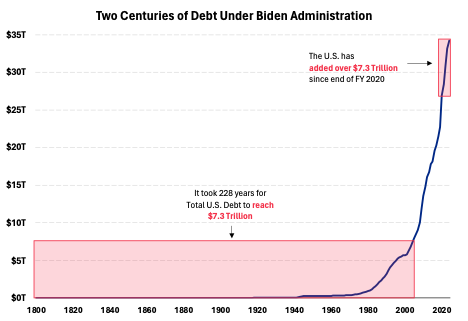

Our total public debt is a staggering $34 trillion, and counting…

U.S. National Debt Clock

Defaulting on debt involves a government’s inability or refusal to meet its debt obligations. This has catastrophic consequences particularly in the case of the United States. If the U.S. were to default it would collapse most financial institutions in the U.S. and globally. It would put the U.S. economy and the globe into a depression that would take over a decade to resolve. Unemployment would skyrocket and social instability would rise dramatically. It would also destroy investor confidence, trigger capital flight, and the U.S. would immediately lose its reserve currency status. To say the least, this is not an option that the U.S. can pursue like many third world countries have done in the past.

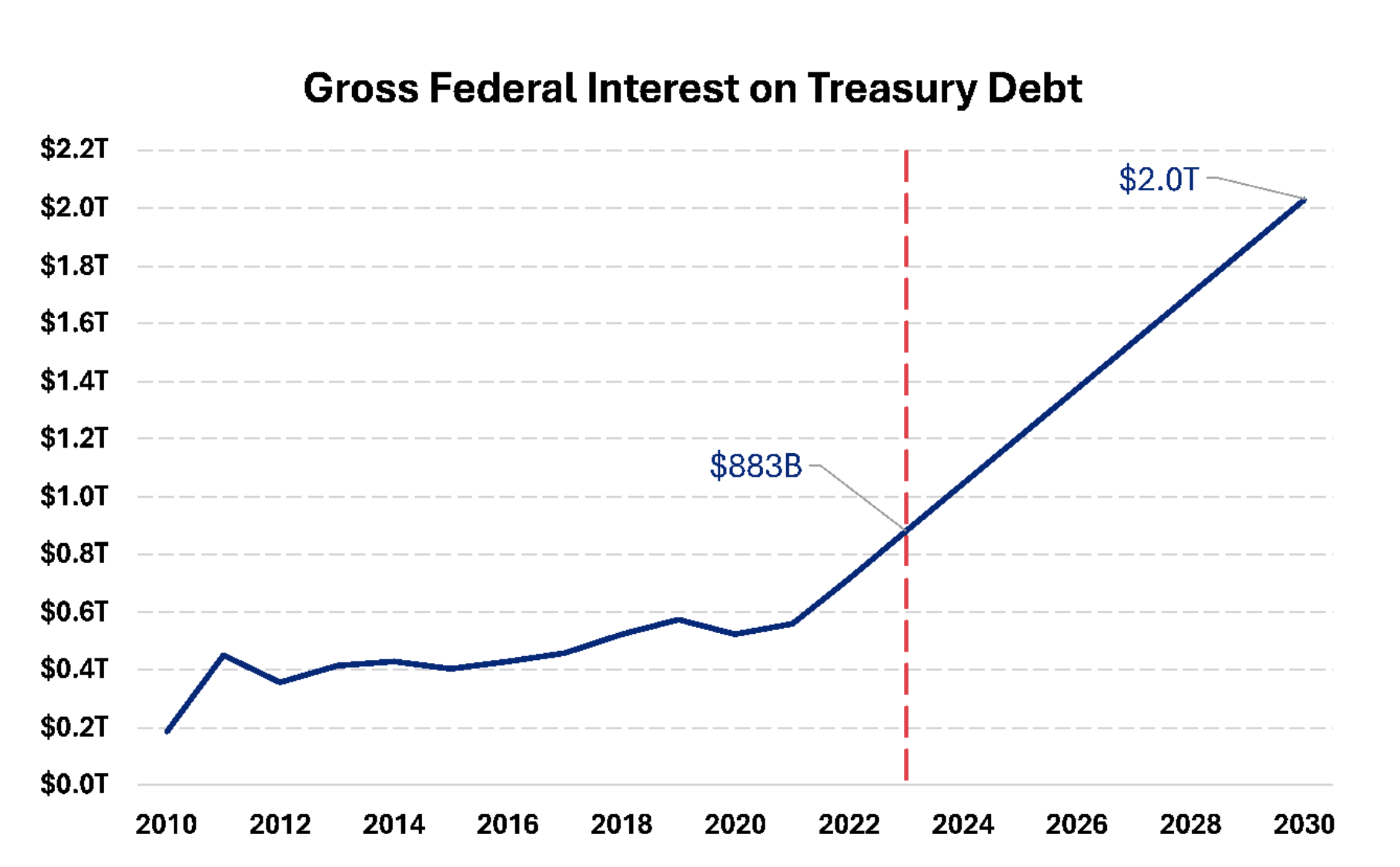

The inflationary approach involves rapidly increasing the money supply to devalue the debt. While this might seem like a convenient solution, it has extremely detrimental effects on the broader population. It devalues people’s savings and is particularly harmful to the elderly who rely on savings because they are no longer employed. Inflation also erodes the purchasing power of individuals and businesses, leading to higher costs of living. This harms everyone in a society but is particularly hard on middle- and working-class families and again, the elderly. Further it starts to have a corrosive impact on economic growth as people have to shift all their income to basic necessities collapsing other industries that do not provide essential goods and services. This ultimately leads to economic stagflation where an economy is no longer growing, but prices continue to increase. This is a painful remedy that lowers the standard of living for all but a very few.

The U.S. has already started down the path of trying to inflate away the debt. The Biden administration has spent trillions even after we were coming out of the COVID lockdowns in 2021 and 2022.

The Federal Reserve, due to the lockdowns of our economy in 2020 and 2021, increased the money supply by 40% during this period. As a result, inflation spiked to the highest levels in 40 years.

Debt per Taxpayer

as of 02/19/2024

Liability per Citizen

as of 02/19/2024